utah tax commission forms

Salt Lake City UT 84114-6600. With information about filing and paying your Utah income taxes and your income.

Vadrs Utah Form Fill Out And Sign Printable Pdf Template Signnow

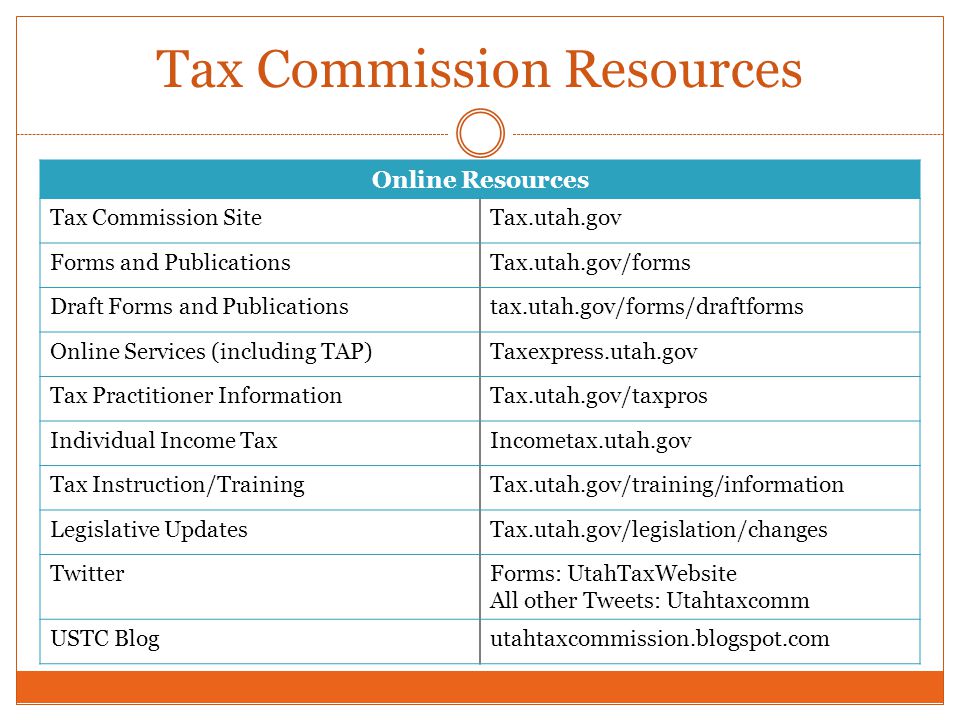

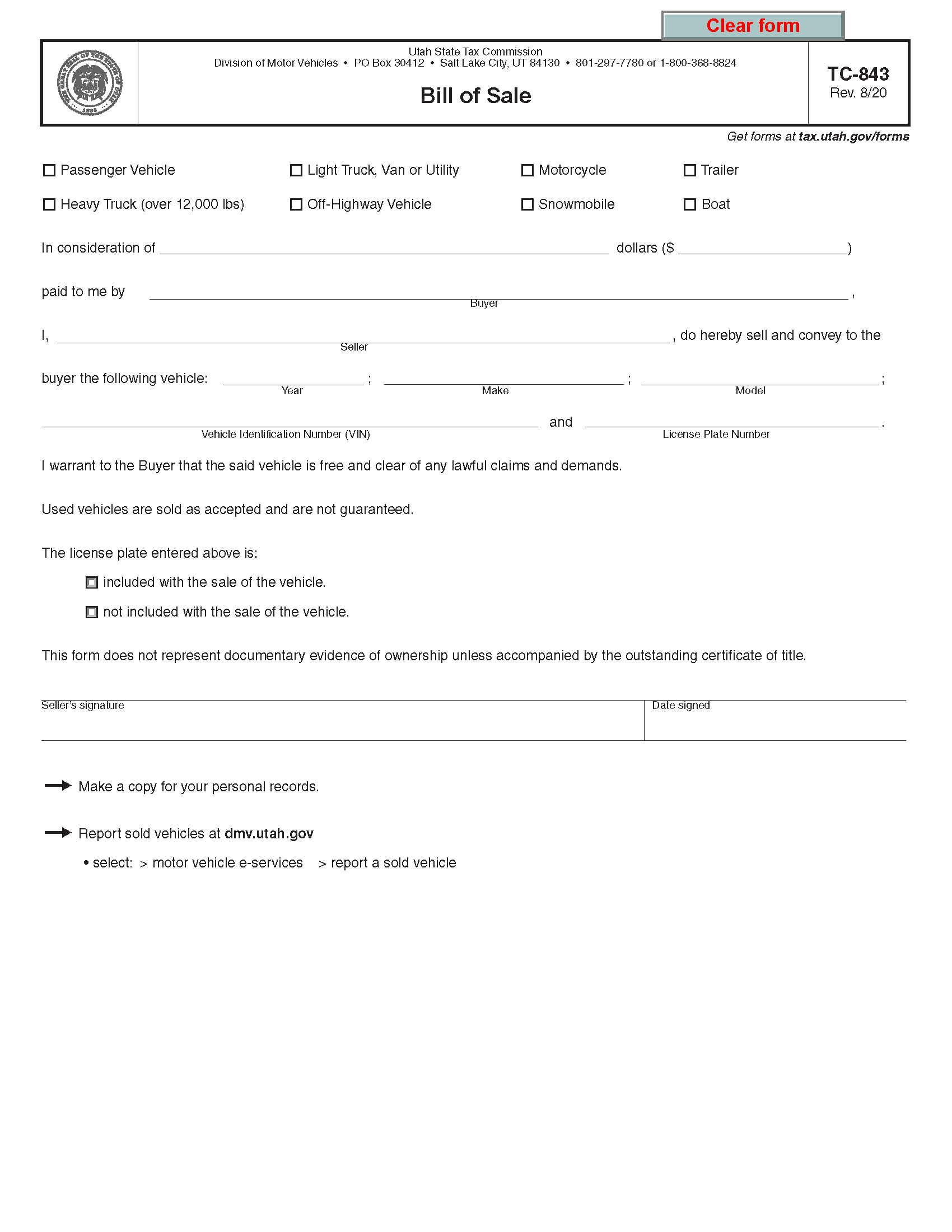

Remember that you can often skip forms altogether by using our Motor.

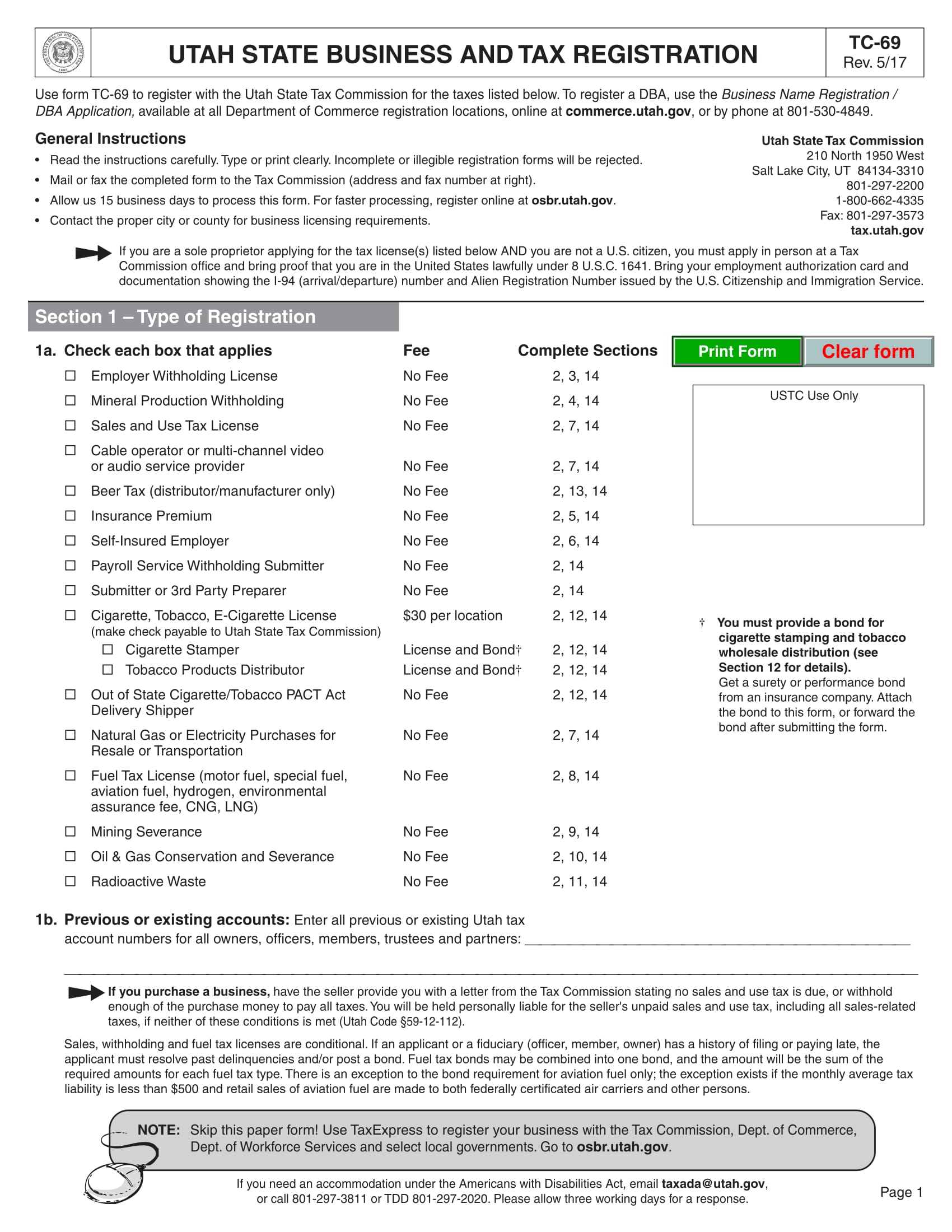

. Property Tax Forms Pubs. TaxFormFinder provides printable PDF copies of 56 current Utah income tax. Motor vehicle forms and publications.

Skip to main content NOVEMBER 1-4 2022 LAS VEGAS CONVENTION CENTER. Details on how to only prepare. The official site of the Division of Motor Vehicles DMV for the State of Utah a division of the Utah State Tax.

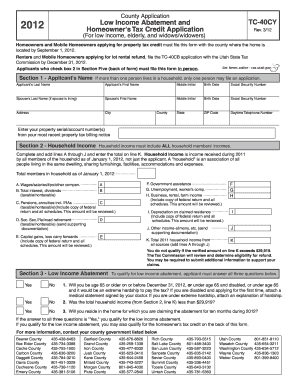

Questions about your property tax bill and payments are handled by your local county officials. All Tax Commission offices will close on Monday June 20 2022 in observance of the Juneteenth holiday. Current Forms Utah State Tax Commission.

Salt Lake City UT 84114-6600. 120 This form should be used in conjunction with Form PT-33A Agreement of Lien Holder For Deferral or Settlement. Nv Sales Tax Form 2020.

Download or print the 2021 Utah Form TC-40 Utah Individual Income Tax Return for FREE from the Utah State Tax Commission. Of Delinquent Property Tax UCA 59 -2 1347 Form PT-33 PT-033 Rev. Printable Utah state tax forms for the 2021 tax year will be.

160 East 300 South 3rd Floor. How to obtain income tax and related forms and schedules. 160 East 300 South 3rd Floor.

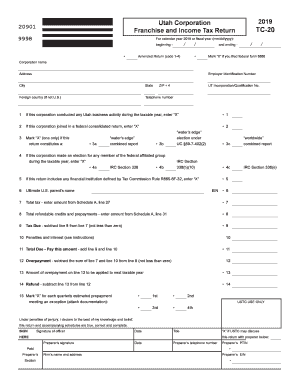

31 2021 can be e-Filed in conjunction with a IRS Income Tax Return. Utah state income tax Form TC-40 must be postmarked by April 18 2022 in order to avoid penalties and late fees. Weve put together information to.

You can narrow the list of forms by choosing one or more types from this dropdown box. Utah State Income Tax Forms for Tax Year 2021 Jan. Application for Property Tax Exemption.

File electronically using Taxpayer Access Point at. Please contact us at 801-297-2200 or taxmasterutahgov for more information. Please contact us at 801-297-7780 or dmvutahgov for more information.

Please contact us at 801-297-7780 or dmvutahgov for more information. Please visit this page to contact your county officials. Please contact us at 801-297-2200 or taxmasterutahgov for more information.

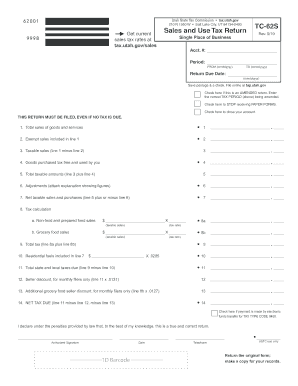

All Utah sales and use tax returns and other sales-related tax returns must be filed electronically beginning with returns due Nov. Filing your income tax return doesnt need to be complex or difficult. Utah has a flat state income tax of 495 which is administered by the Utah State Tax Commission.

Utah Sales Tax A Policymakers Guide To Modernizing Utah S Sales Tax

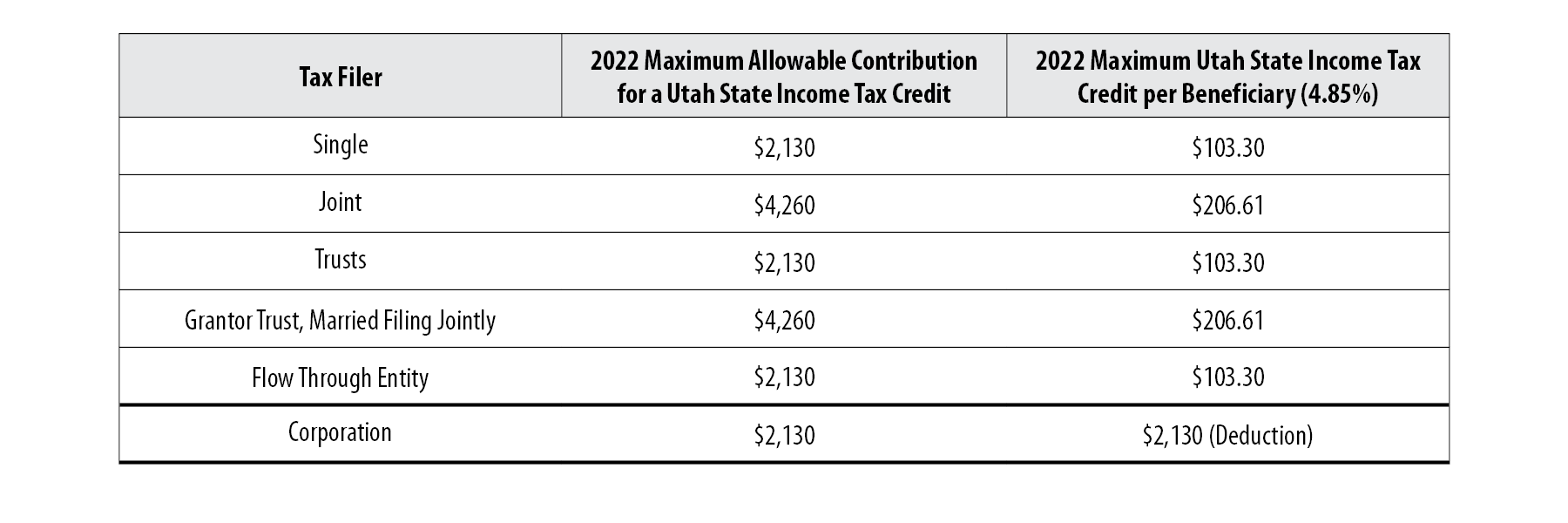

Utah Llc Tax Structure Classification Of Llc Taxes To Be Paid

Tc 20 Forms Utah State Tax Commission Fill Out Sign Online Dochub

Free 10 Required Forms For Opening And Operating A Bakery Business In Pdf

Free Utah Bill Of Sale Forms Pdf Word

Utah Lost Title Bond A Comprehensive Guide Bond Exchange

Utah Sales Use Tax Form Fill Out And Sign Printable Pdf Template Signnow

Utah State Tax Benefits Information

Fillable Online Utah State Tax Commission Address Form Fax Email Print Pdffiller

Free Utah Tax Power Of Attorney Form Tc 737 Pdf Eforms

Federal And State Tax Forms Payson Utah

Guest Opinion Why I Support Utah County Proposition 9 Utah Policy

Utah Tax Forms And Instructions For 2021 Form Tc 40

Form Tc 62s Fillable Utah Sales And Use Tax Return For Single Places Of Business

Utah Form Tc 895 Fill Out Printable Pdf Forms Online

Tax Utah Gov Forms Current Tc Tc 41inst